REAL ESTATE INVESTMENT: Opportunity Zone Projects

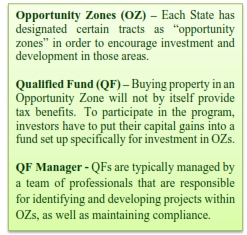

There is no question the Qualified Opportunity Zone Fund program provides investors with amazing tax benefits. But, where are these «Zones» and what kind of projects will you be investing in?

According to the IRS:

Opportunity Zones are an economic development tool that allows people to invest in distressed areas in the United States. Their purpose is to spur economic growth and job creation in low-income communities while providing tax benefits to investors.

The legislation passed with bipartisan support. The Republicans liked the tax savings, while the Democrats liked the investment in under-developed neighborhoods.

Where are the Opportunity Zones?

Congress left it to individual states to determine what areas would be designated as an Opportunity Zone. (See List of Designated Tracts) There are some nice interactive mapping tools available online as well.

With some notable exceptions, you can expect opportunity zones to be neighborhoods traditionally considered «under-developed» or «disadvantaged.»

Projects Permitted by a Qualified Fund

Keep the purpose of the legislation in mind, you will understand why Qualified Funds (QFs) are not permitted to invest in just any kind of project. Here are some of the guidelines.

New Construction

QFs are not allowed to buy a property and simply throw some paint on it. The project must be brand new construction or a «substantial rehabilitation,» which means the QF put more money into the improving the property than it did to purchase the property.

Examples of Qualifying Projects

Generally, QFs are expected to invest in projects that bring a benefit to the community by creating jobs or otherwise. Some examples include the following:

- Affordable Housing

- Community Revitalization

- Economic Development

- Infrastructure Investment

- Mixed-use Development

- Multifamily Residential

- Renewable Energy Investment

- Single Family Residential

- Small Business Development

- Workforce Housing

Profitability

Naturally, an important aspect of the projects is profitability. You can expect good QF managers to make strategic decisions when determining what projects to undertake in the Opportunity Zone. After all, investors not only receive the capital gains from the projects, but they also participate in the yearly cash flow.

See our related articles for more on how to take advantage of the Qualified Opportunity Zone program:

- What are the benefits of a QF?

- Who can invest in a QF?

- What kind of money qualifies for a QF?

- What is the risk analysis for a QF?

- How does a QF compare with a 1031 Exchange?

- Where do I find a QF to invest in?