REAL ESTATE INVESTMENT: Qualified Opportunity Zone Fund

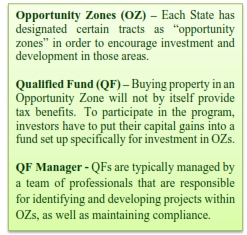

It is not too late to shelter your capital gains from last year. The Qualified Opportunity Zone Fund Program allows investors to defer, or entirely eliminate, federal taxes on capital gains (and 1231 gains) from qualifying investments.

The Opportunity Zone program has been around since 2017 but, since the Pandemic, it has received some beneficial tweaks you should know about.

Benefits

Some of the deadlines under the program have already passed, but the benefits still available are impressive.

The first thing you need to understand is that we’re really talking about TWO separate tax-saving opportunities. We’ll call them GAIN #1 and GAIN #2.

GAIN #1 – Previous Capital Gains

Here, we’re talking about the capital gains you made in 2021 (or the first quarter of 2022).

You’re just sitting on this money at the moment, getting ready to pay taxes on it. But, hold on. There is an alternative.

If you act quickly, you can take those gains from 2021 and reinvest them in a Qualified Opportunity Zone Fund. That will exempt those gains from your 2022 tax return.

Then, you can defer the tax on those 2021 gains until 2027. So, you have six (6) years in which you can make money on Uncle Sam’s money. Let me give you an illustration.

Example: Let’s say you sold real property last year and made a profit of $500,000. Depending on your tax bracket, you probably owe 20% in capital gains tax on that money, which would be $100,000. Under this program, Uncle Sam basically says:

You can hold onto my $100,000 as long as you reinvest it in an Opportunity Zone. And, whatever you earn on that money in the next six years, you get to keep.

That is not a bad deal AT ALL. But, brace yourself. Here comes the crazy part.

GAIN #2 – Capital Gains from QF

Continuing with our example, if you leave that $100,000 investment in the Qualified Fund (QF) for at least 10 years, you are going to get all the capital gains derived from that investment TAX FREE. Let that sink in.

Example: Let’s say you find a good QF for your $100,000. You can probably expect your Fund Manager to grow the fund at a rate of 10% to 15% per year. That will essentially double your investment in five (5) years. So, by year five, give or take, your $100,000 investment will have grown to $200,000. And, by year ten (10), it will be worth $300,000. That leaves you with a capital gain of $200,000 by the end of the 10-year cycle.

Guess what. You will pay exactly zero taxes on that $200,000 gain.

That, my friends, is rather amazing.

Now that we have your attention, look for follow up articles with details on _

- Who can invest in a QF?

- What kind of money qualifies for a QF?

- What kind of projects are in an Opportunity Zone?

- What is the risk analysis for a QF?

- How does a QF compare with a 1031 Exchange?

- Where do I find a QF to invest in?