REAL ESTATE INVESTMENT: Opportunity Zone vs. 1031 Exchange

The Qualified Opportunity Zone Fund program began in 2017, but investors have only recently begun to really understand and take advantage of it. As awareness grows, investors are migrating away from 1031 exchanges to Opportunity Zone Funds. This side-by-side comparison of the two tax-savings programs explains why.

Commonalities

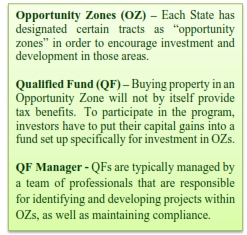

Both 1031 Exchanges and Opportunity Zone Funds, called “Qualified Funds” (QF), give investors incentives to reinvest their capital gains. Specifically, both programs permit investors to defer paying tax on their capital gains. That essentially lets an investor make money on Uncle Sam’s money for free. Legislators use this effective technique to encourage real estate investment and development. There are, however, important differences between 1031 Exchanges and QFs.

Tax Savings

1031 Exchange – Indefinite Deferral

As many people know, when an investor sells a piece of real estate, the investor has an opportunity to take the initial investment money plus the profit and reinvest both in another property of equal or greater value. The investor can continue this practice indefinitely, until death, and continue to defer the taxes. This feature lends itself to investors rolling their money into increasingly expensive pieces of property, thereby growing their asset. That is very nice, but the investor will eventually have to “pay the piper.”

QF – Deferral plus Forgiveness

Like 1031 Exchanges, QFs also provide tax deferral on capital gains. One important difference, however, is that the investor will not continue rolling the money over into new projects indefinitely in order to escape paying the capital gains tax.

Under the OZ program, the tax due on the money invested in the QF (Gain #1) will have to be paid in 2027. So, the ride does come to an end with respect to Gain #1.

However, as for the capital gains made through investment in the QF (Gain #2), that will be tax free as long as you keep the money in the QF for at least 10 years. So, for Gain #2, you can take your money out without triggering any tax liability at all.

Liquidity; Original Principal

Here is another potential advantage to the OZ program.

1031 Exchange – All or nothing

When you roll your money into a 1031 Exchange, you have to invest all the money you got back from the sale of the property–i.e. both the initial investment and the capital gains. That is why you will generally buy increasingly expensive replacement properties. Otherwise, you have to pay taxes on any money not reinvested.

QF – Free up original principal

With a QF, you are not required to roll over the original capital investment. If you so choose, you could take that money out and just reinvest the capital gains.

1031 Example: Investor purchased a home for $300,000 and, two years later, sold it for $500,000. If Investor does a 1031 Exchange, with full tax deferral, he must purchase a replacement property worth $500,000 or more.

QF Example: Investor purchased a home for $300,000 and, two years later, sold it for $500,000. If Investor invests in a QF, he can hold onto the $300,000 without any tax reprecussions. He only needs to put the $200,000 capital gain into the QF. After 10 years, Investor’s $200,000 investment in the QF generates a gain of $400,000. At this point, Investor can take all his money out of the QF — i.e. $600,000 — tax free.

Deadlines

1031 Exchange – 45 days & 180 days

With a 1031 Exchange, the rule is that the sale of Property A and the purchase of Property B must be parts of a single integrated transaction. That is why it is called an “exchange.”

- You have 45 days from the date you sell Property A to identify a potential Property B.

- The exchange must be completed no later than 180 days after the sale of Property A or within 180 of the due date to file your taxes (with extensions), whichever comes first.

The second deadline is not too hard to meet, but the first one can cause some stress.

QF – 180 days

The basic rule is the capital gains must be placed in a QF within 180 days of the sale of the asset.

There are some exceptions, all of which provide additional time for the reinvestment. For example, if the investor is a partnership, the individual partners have 180 days from the end of the tax year (December 31st) to place the capital gains in a QF.

Note: There are special rules on the timing for reinvestment of 1231 gains.

Often, an investor that misses the 45-day deadline for a 1031 Exchange can salvage the tax planning by placing the money in a QF instead.

Control of Funds

1031 Exchange – Qualified Intermediary

As you may have learned from our previous article here, one of the major pitfalls with a 1031 Exchange is that the funds from sale of Property A can never be in the possession of control of the investor prior to purchase of Property B. That is why it is crucial to use a Qualified Intermediary. Failing to do so can easily disqualify the entire transaction and lead to penalties.

QF – Relaxed Rule

By contrast, investors in a QF are not subject to any “control” restrictions. As long as the capital gains from sale of Property A are placed in a QF within the relevant timeframe — which, at a minimum, is 180 days, the tax benefits will be preserved. That gives investors the ability to use the money in the interim, if they so choose.

Miscellaneous Differences

In some ways, the programs are simply different. For example, there is no “like-kind” requirement when investing in a QF since the transaction is not strictly an “exchange.”

Similarly, when investing in a QF, the funds can be any kind of capital gains or 1231 gains. (Click here for a list of qualifying funds) With a 1031 Exchange, of course, the only money that can be reinvested is the original principal and capital gains from Property A. So, the Opportunity Zone program is much broader in this sense.

Lastly, a QF is likely to bring some measure of diversification to the investment. Most QFs are large enough to hold multiple projects of differing types. (Click here for examples of qualifying projects). That aspect potentially reduces risk, as compared to a 1031 Exchange, where all the money from Property A must go into Property B.

Conclusion

Objectively speaking, the Opportunity Zone program does seem to have certain advantages over the traditional 1031 Exchange program. But, that is not to say investment in a QF is for everyone.

For example, I have investor clients who enjoy the “hands on” aspect of developing one project, selling, and reinvesting in another. 1031 Exchanges are perfect for them because they remain in control of all their projects, and they enjoy the work.

For most other investors, though, the Opportunity Zone program is an absolute jewel. And, unless Congress decides to extend the program, it will not be available for too much longer. So, get in while you can.

Now that we have your attention, look for follow up articles with details on _

- What are the benefits of the Opportunity Zone program?

- Who can invest in a QF?

- What kind of money qualifies for a QF?

- What kind of projects are in an Opportunity Zone?

- What is the risk analysis for a QF?

- Where do I find a QF to invest in?