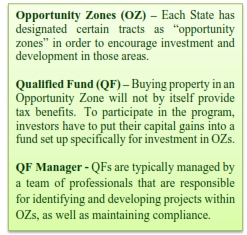

REAL ESTATE INVESTMENT: Funds that Qualify for an Opportunity Zone

The Qualified Opportunity Zone Fund program offers some incredible incentives for all investors. But, there are limitations to the kind of money that qualifies for the special tax treatment.

The good news is that, for purposes of a QF, what is considered “capital gains” is not just proceeds from the sale of real estate. In fact, all of the following are qualified capital gains:In order to get the tax advantages available under the Opportunity Zone program, you have to invest “qualified capital gains.” So, it is not just any kind of money that can be invested in a Qualified Fund (QF). For example, if you have put away some cash from your regular salary or other compensation, that money will not qualify for the tax benefits because it is not “capital gains.”

- Sale of Real Estate

- Sale of stocks and bonds

- Sale of shares in a corporation

- Sale of a partnership interest

- Sale of cryptocurrency

- Sale of REIT

- Sale of land

- Sale of machinery

- Sale of timber and other natural resources

- Sale of unharvested crops and livestock

- Gains from leaseholds (at least 1 year old)

So, as long as the funds you intend to invest can be defined as “capital gains,” you can invest in a QF and receive the very advantageous tax benefits of the Qualified Opportunity Zone program. That is one significant advantage of a QF over the traditional 1031 exchange.

See our related articles for more on how to take advantage of the Qualified Opportunity Zone program:

- What are the benefits of a QF?

- Who can invest in a QF?

- What kind of projects are in an Opportunity Zone?

- What is the risk analysis for a QF?

- How does a QF compare with a 1031 Exchange?

- Where do I find a QF to invest in?